Overview

Editor's note: Surgical robots are a subdivision of high-end medical devices that integrate medicine, mechanics, biomechanics, and computer science. Using clear imaging systems and articulated robotic arms, they assist surgeons in performing minimally invasive procedures. This article summarizes the China market, the industry value chain, business models, and future prospects for surgical robots.

Globally, the surgical robotics market concentrates in five main areas: laparoscopic robots, natural orifice robots, orthopedic robots, endovascular and percutaneous robots. Laparoscopic systems are the earliest and most mature segment, accounting for over 60%, led by the da Vinci system. Orthopedics is the second-largest segment, over 15%, represented by companies such as Stryker. Other categories, including endovascular, natural orifice, and percutaneous puncture robots, currently have smaller market shares. As the field becomes more specialized, new types of surgical robots are expected to emerge.

1. China surgical robotics market status

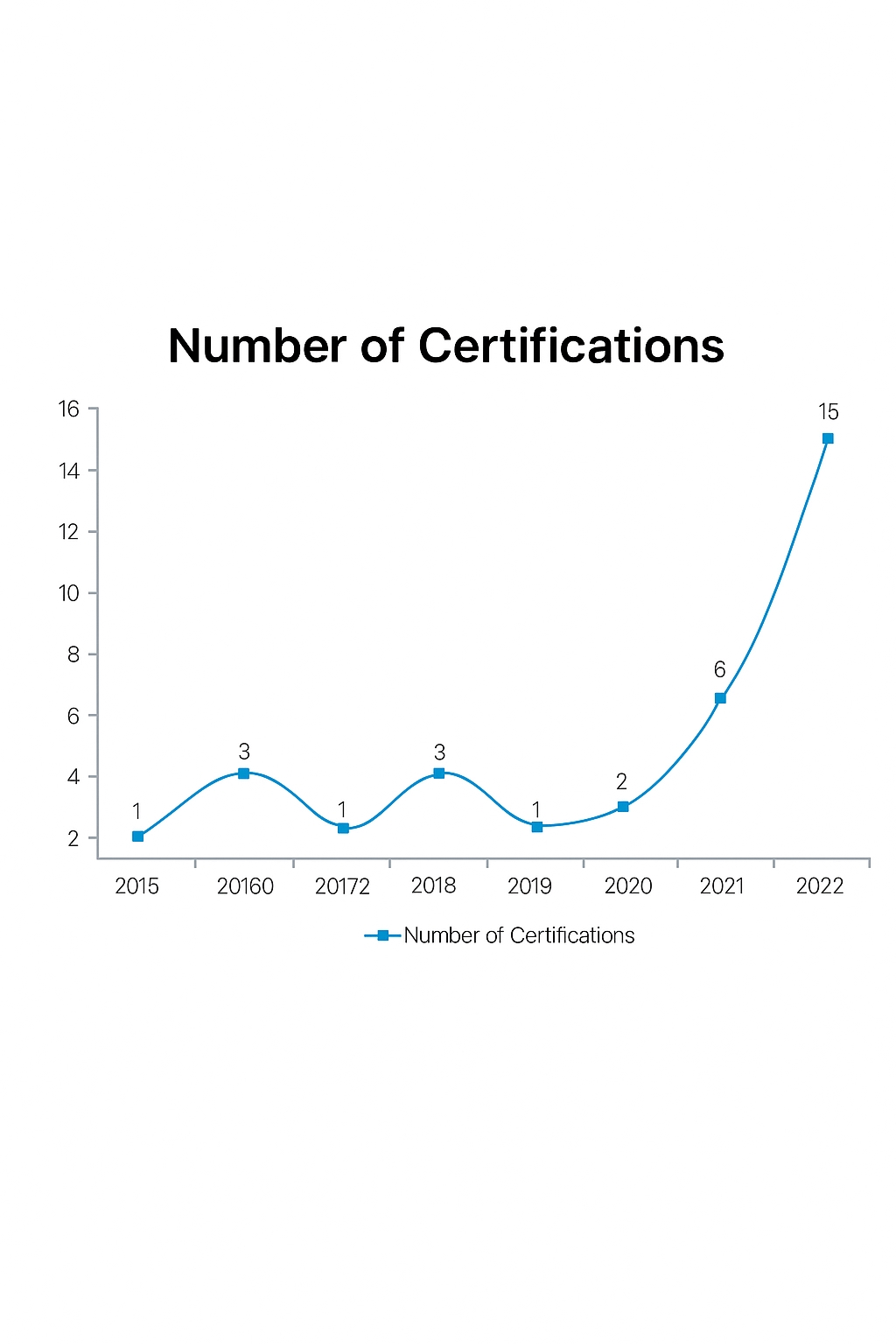

Although China's surgical robotics sector started later than those in Europe and the United States, it entered a rapid growth phase over the past decade. In 2010, the company Tianzhihang developed an orthopedic surgical robot that received approval, becoming the first domestically listed surgical robot. Since then, many China-based systems have entered clinical trials across various segments, and several product categories already feature multiple approved devices.

Surgical robots have also become a popular sector in the Chinese capital market; 29 financing rounds were completed in 2022. One estimate put the global market at RMB 70.4 billion in 2021, with a projection to reach RMB 399.4 billion by 2030.

2. Industry value chain

The industry value chain can be divided into upstream raw materials and core components, midstream body assembly, system integration and software development, and downstream end-use. The highest technical barriers are in three upstream core components: servo systems, gear reducers, and controllers. These component markets are mainly dominated by suppliers from the United States, Germany, and Japan. In terms of device value composition, reducers, servo systems, and controllers account for approximately 35%, 20%, and 15% of total cost respectively, meaning the three core components comprise about 70% of device cost.

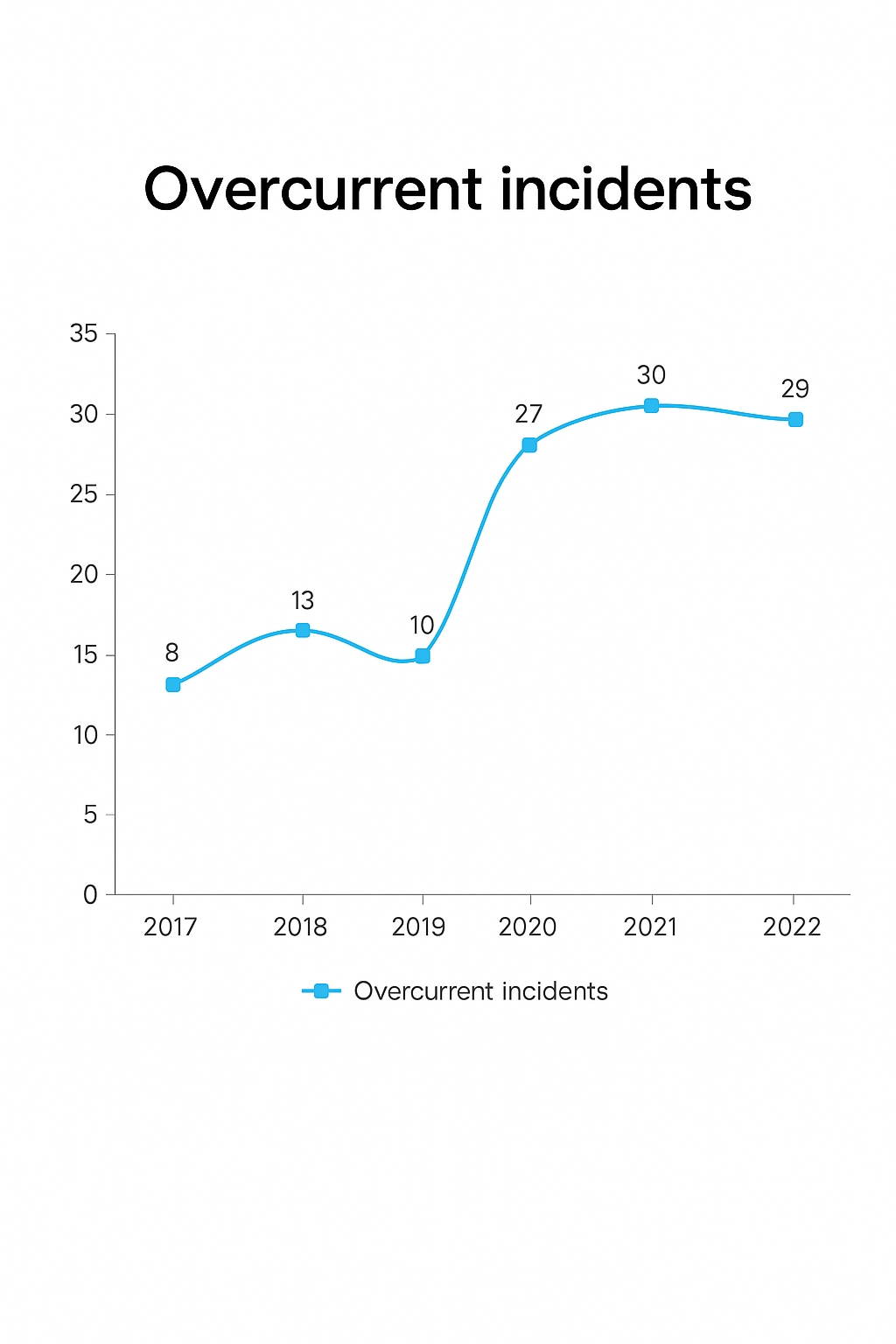

At the downstream product level, long development cycles and constraints in upstream component supply and technology have limited mass production and price reductions for products developed in China. This has slowed adoption in end-user settings, and currently surgical robots are mainly used in large tertiary public hospitals.

Imported surgical robots are typically expensive, and their consumables and maintenance costs are also high, so only a small number of large tertiary hospitals can afford them. Compared with traditional surgery, robot-assisted operations often cost an additional RMB 20,000–30,000, and the limitations of public medical insurance coverage further restrict patient payment capacity. Overall, the expansion of surgical robots from large tertiary hospitals to primary care institutions in the Chinese market remains a long-term challenge.

3. Business models

Surgical robotics companies typically generate revenue from three sources: systems, consumables, and services. Systems refer to the initial sale of the complete robot, including hardware and software, sold to hospitals for a one-time price. Consumables are surgical instruments used with the robot, such as instrumented arms and other high-value disposables sold on an ongoing basis. Services include maintenance, training, and other post-sale support.

In the short term, revenue is dominated by device sales, while in the long term consumables are expected to become the main revenue stream. In 2020, systems accounted for 55.8% of China market sales and consumables 38.2%. By contrast, in the United States in the same year system revenue accounted for only 25.3% while consumables accounted for 57.7%. As procedure volumes increase in China, revenue structure is expected to gradually shift toward the U.S. pattern, with consumables becoming the dominant source of income.

In orthopedics abroad, most companies that produce and sell orthopedic surgical robots also produce related implant consumables, often covering spine, joint, and trauma implants. From established orthopedic manufacturers such as Medtronic, Stryker, and Johnson & Johnson, to newer players like Globus and Acelus, the common strategy is to combine consumables and robots: using a company's robot typically leads to using that company's implants. Some companies have even developed implants specifically designed for robotic workflows, such as designs that separate screw heads from pedicle screws for robotic compatibility.

4. Outlook

From a market perspective, although China started later and the current scale is relatively small, ongoing investment and policy support are driving a shift from reliance on imported systems to technology innovation by China-based players. Surgical robots developed in China are expected to capture a growing share of the domestic market and gradually compete with international products. The market for surgical robots in China grew from RMB 853 million in 2016 to RMB 2.935 billion in 2020, a compound annual growth rate (CAGR) of 36.2%. Forecasts estimate the China market could reach RMB 58.426 billion by 2030, a CAGR of 34.9% from 2020 to 2030. Over the long term, wider adoption of surgical robots represents a significant incremental market opportunity.

From a product perspective, deeper integration of surgical robots with artificial intelligence, brain-computer interfaces, AR/VR, and big data will improve interaction with clinicians and patients, enable more precise perception of data, objects, and environments, and drive intelligent integration in medical systems. Surgical robots are likely to expand into more surgical specialties, offering higher precision, sensitivity, and intelligent remote-control capabilities. Devices will also trend toward less invasive approaches, from multiport to single-port and natural orifice procedures, reducing incision size and potentially lowering costs.

From a commercial perspective, high costs relative to conventional surgery remain a major constraint. Implementation of DRG payment models and inclusion of orthopedic consumables like joint and spinal implants in centralized procurement may increase hospital willingness to adopt surgical robots.

Domestic surgical robotics companies face both opportunities and challenges. To address a large untapped market and leverage a supportive policy environment, companies will need to collaborate with stakeholders and strengthen core competitiveness to cross the innovation "valley of death" with support from regulatory and funding authorities.

ALLPCB

ALLPCB