Overview

Wearable sensors enable continuous monitoring of users' vital signs, fitness data, and physical and mental health. As wearable device applications and the market expand, sensors that can detect a range of parameters—from glucose levels to stress, from motion to temperature—are gaining attention. According to a MEMS consultancy, the UK research company IDTechEx, based on a decade of accumulated research into wearable hardware technologies, analyzes the current and future technical and commercial prospects of this emerging industry in its report.

From step counting to broader health monitoring

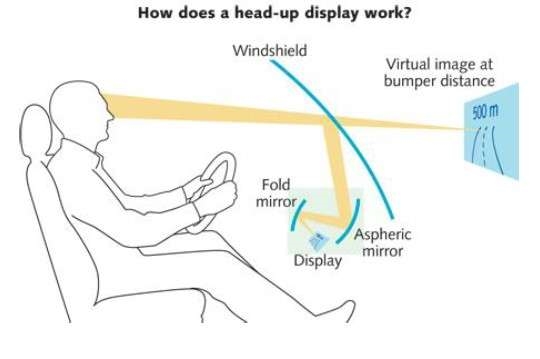

People increasingly use wearable sensors to monitor activity levels. Wearable sensors originated with simple step counting; the market has since expanded into more complex health monitoring. Innovations in wearable sensor technology, realized through devices such as smartwatches and electronic skin patches, have greatly extended the range of measurable biomarkers. These advances address growing demand for remote patient monitoring and decentralized clinical trials, while raising consumer expectations for easier access to health data and further integration of sensors into augmented reality and virtual reality devices and accessories for more immersive experiences.

Distinguishing hype from practical opportunities

Not all wearable sensors have clear market prospects, and distinguishing hype from practical value is an increasing challenge for investors. The report details sensor types and the detectable biomarkers, covering 12 primary sensor categories, including inertial sensors, optical sensors, and biochemical sensors for monitoring vital signs, stress, sleep, and even brain activity. IDTechEx outlines the key opportunities and challenges for each sensor type to achieve commercial success over the next decade.

Motion sensors: beyond step counting

Motion sensor hardware is mature, and almost all wearable devices now include accelerometers. As manufacturers face margin pressure from market competition, expanding application space is critical for sustaining growth. The report examines emerging use cases such as health-insurance incentives, clinical trials, and monitoring of professional athletes. It also compares major MEMS sensor manufacturers and provides interview-based company profiles.

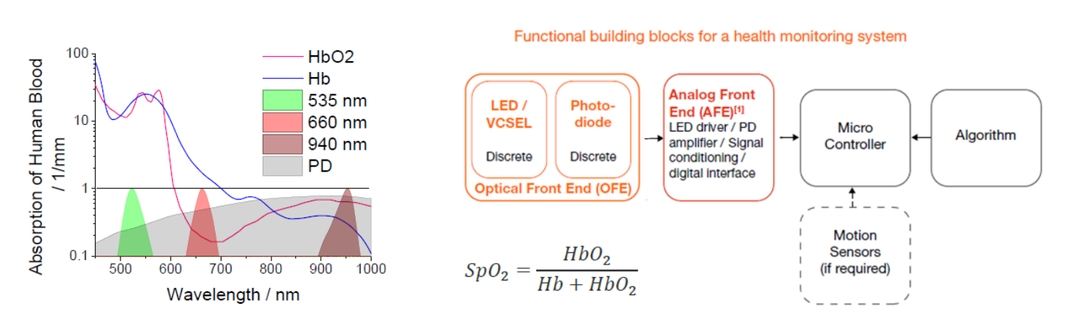

Optical sensors: more than heart rate

Users of smartwatches are familiar with the red and green lights on the device back, which are used to sense heart rate or blood oxygen and to derive metrics such as calorie expenditure, VO2 max, and sleep quality.

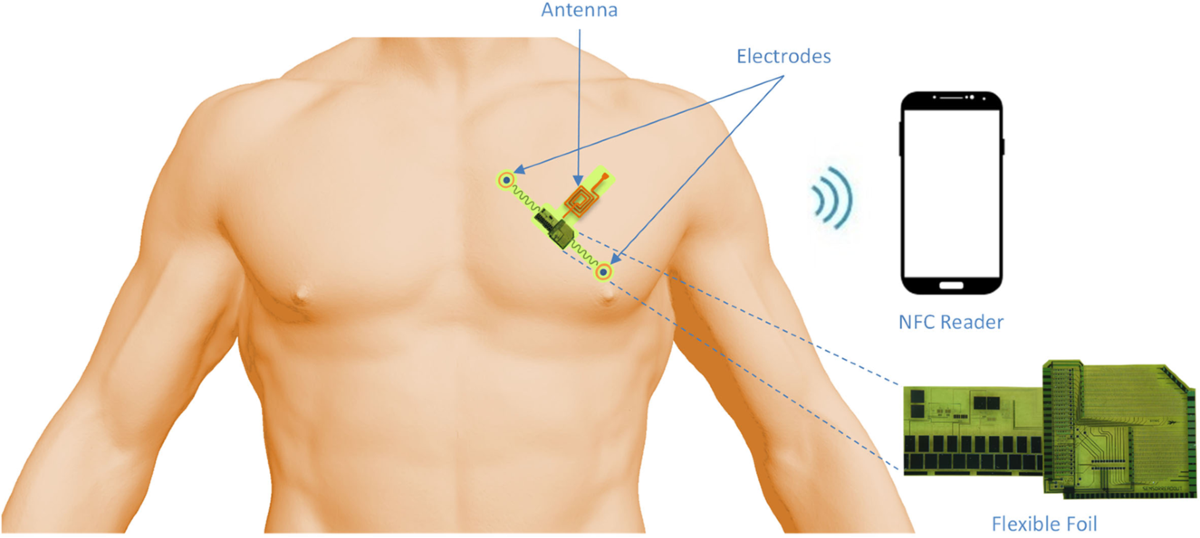

Electrodes for monitoring heart, muscle, and brain activity

Introducing conductive materials into wearables is a simple concept, yet it has enabled a range of wearable sensors, including wet electrodes on the skin to measure cardiac signals, dry electrodes in earphones for brain-signal analysis, and microneedles in skin patches to quantify muscle activity. This opens broad application space for electrodes, from vital-sign monitoring and sleep analysis in healthcare to emotion and stress monitoring for marketing and productivity applications. The report covers four key electrode types: wet electrodes, dry electrodes, microneedle electrodes, and electronic skin, and summarizes key material and manufacturing requirements.

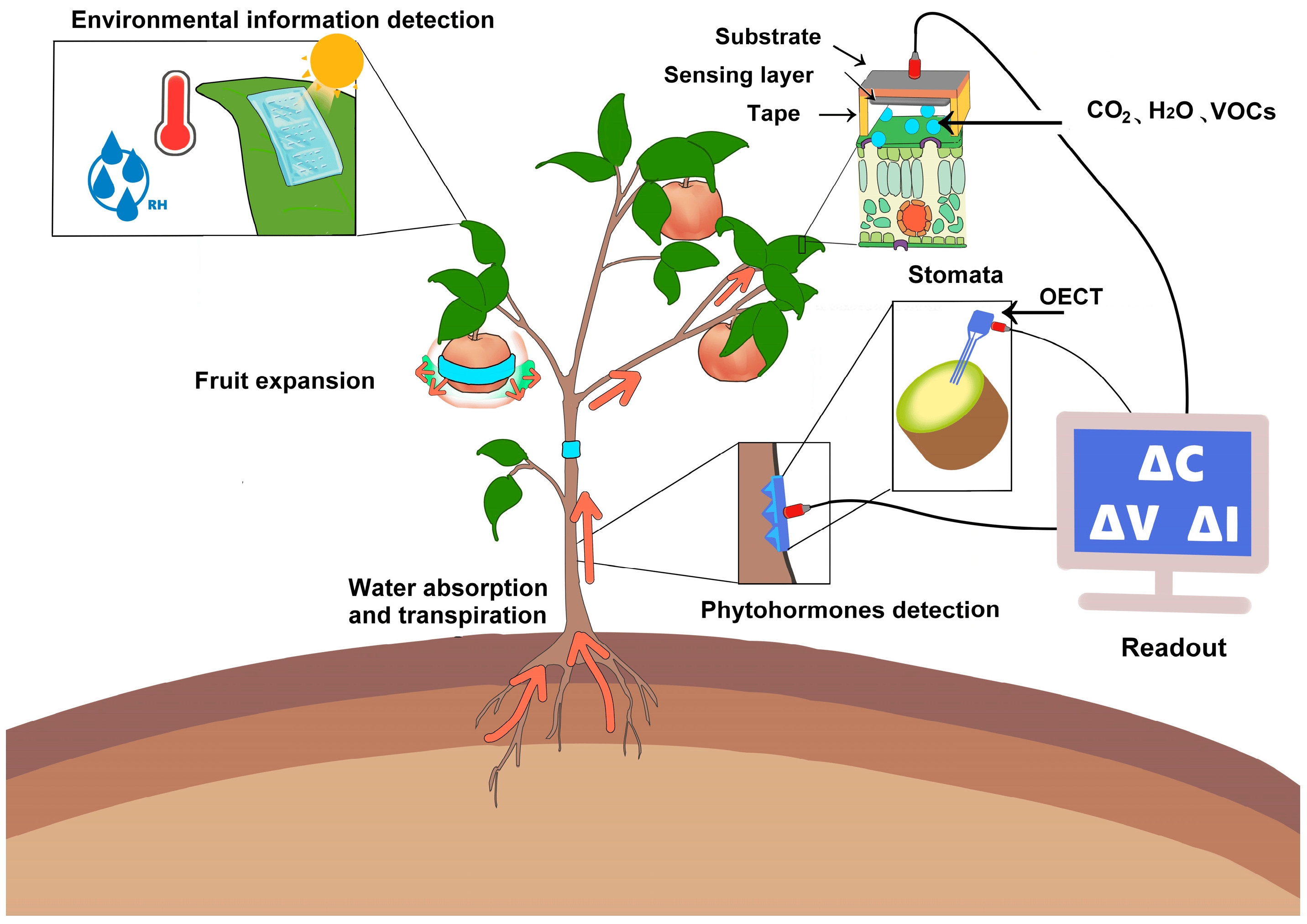

Chemical sensors as an alternative to finger-prick blood tests

Chemical sensors can allow people with diabetes to monitor glucose without finger pricks. However, current commercial devices still require a needle inserted beneath the skin. Demand for low?invasiveness wearable sensors remains high. The report outlines the current continuous glucose monitoring market and analyzes competing technologies that use microneedles and other biofluids. It also includes a dedicated chapter on emerging biomarker detection, evaluating opportunities for chemical sensors beyond diabetes management, with a focus on hydration, alcohol, and lactate.

Market overview and forecast

Overall, the report provides insight into how wearable sensors may become integrated into daily life, highlighting their value within the broader trend of user self-quantification. Growth drivers in this field include digital health, remote patient monitoring, extended reality applications, and comprehensive analytics for sports and fitness.

ALLPCB

ALLPCB